When it comes to managing healthcare expenses, Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are two popular options that can help you save money. While they share some similarities, their differences can significantly impact your financial and healthcare planning. Let's explore the key distinctions and what they mean for you.

What is an HSA?

An HSA is a tax-advantaged savings account available to individuals with a high-deductible health plan (HDHP, also sometimes called an HSA-eligible plan). The Marketplace offers several Bronze HDHPs that are HSA-eligible. HSAs offer three primary tax benefits:

-

Tax-free contributions: Contributions to your HSA are pre-tax or tax-deductible, reducing your taxable income.

-

Tax-free growth: Any interest or investment earnings in your HSA grow tax-free.

-

Tax-free withdrawals: Funds can be withdrawn tax-free for qualified medical expenses.

One of the standout features of an HSA is its flexibility. The funds in your HSA roll over year to year, meaning there's no pressure to spend the balance before a specific deadline. Additionally, HSA funds can be invested, allowing your savings to grow over time.

It's important to note that while funds in your HSA never expire, you can only contribute to your HSA while you are enrolled in an HDHP or HSA-eligible plan. You should also be aware that HDHPs are not allowed to cover any benefits before deductible except for preventive services. Make sure you are prepared to pay the full contracted price for services and prescriptions if you enroll in an HDHP.

What is an FSA?

An FSA is a pre-tax benefit account offered by employers that allows you to set aside money for eligible healthcare expenses. Like HSAs, FSAs reduce your taxable income and help cover out-of-pocket medical costs. However, FSAs differ in a few significant ways:

-

Use-it-or-lose-it rule: FSA funds typically expire at the end of the plan year, although some employers offer a grace period or allow you to roll over a small amount (up to $610 in 2024).

-

Employer-sponsored: You must participate in an employer-sponsored plan to open an FSA.

-

No investment options: FSA funds cannot be invested.

FSAs are ideal for individuals with predictable annual healthcare expenses, such as routine check-ups, prescriptions, glasses and contact lenses, or planned procedures.

Key Differences at a Glance

|

Feature |

HSA |

FSA |

|

Eligibility | Requires a high-deductible health plan | Employer-sponsored only |

|

Fund Rollover | Yes

| Limited or none |

|

Contribution Limit (2025) | $4,300 (self) / $8,550 (family) | $3,300 |

|

Investment Options | Yes | No |

|

Portability | Yes, remains with you even if you change jobs | No, tied to your employer |

Which Option is Right for You?

Choosing between an HSA and an FSA depends on your healthcare needs, employment situation, and financial goals. Consider the following:

-

HSA: Ideal if you have a high-deductible health plan, want to invest in your healthcare savings, and prefer the flexibility to carry funds forward. Some Marketplace plans are eligible to be used with an HSA.

-

FSA: Best if your employer offers this benefit and you anticipate consistent, predictable healthcare expenses within a year. May only be used with employer-sponsored coverage.

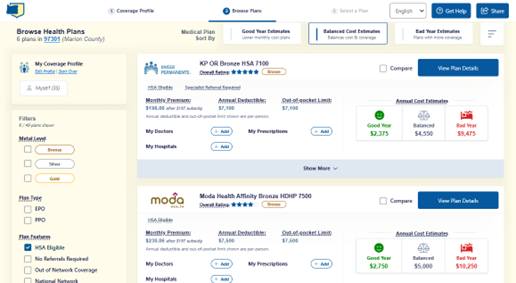

Finding the Best HSA-eligible Marketplace Plan

OregonHealthCare.gov offers a quick and easy-to-use

Window Shopping tool. The tool allows users to filter plans for HSA Eligible plans.

Final Thoughts

Both HSAs and FSAs are excellent tools for managing healthcare costs while reducing taxable income. By understanding their differences and benefits, you can make an informed decision that aligns with your financial and medical needs. Insurance agents and brokers are able to provide one-on-one guidance. Find one at

OregonHealthCare.gov/GetHelp.